October 2025: Banks synchronize IBAN and names

What will be important now and how you can react

From October 9, 2025, banks will synchronize IBANs and names for transfers. This means that the recipient's name and the account holder's name must largely match.

The so-called "Verification of Payee" (VoP) will close an EU legal loophole from now on. Transfers will therefore be more secure. However, customers now bear more responsibility.

In this article, we first clarify general questions and then look at what will be important for companies.

Everything important at a glance

- VoP, i.e. the matching of names and IBANs, is mandatory in the EU for almost all SEPA credit transfers from October 9, 2025.

- Small discrepancies in the name are not a problem.

- A major discrepancy in the name will result in a warning. The transfer can still be made at your own risk.

- The change also affects collective transfers. However, SEPA direct debits are excluded.

What will change from October 2025 and why?

From October 2025, banks and savings banks will have to check for each transfer whether the recipient's name and the name in the IBAN are the same.

This is not only to avoid typing errors. The change should also make a common scam, where a transfer with the correct name but incorrect IBAN is redirected, a thing of the past.

What many people don't know: Until now, it was up to the banks themselves whether they matched the recipient's name with the IBAN. From October 9, 2025, however, this will be mandatory for banks throughout the EU.

The so-called "Verification of Payee" (VoP) does not only apply to SEPA transfers made via online banking. In-branch transfers and real-time transfers are also affected.

How strictly are the IBAN and name checked?

The check takes place automatically in the background after the transfer data has been entered, before a payment is officially authorized.

Within a few seconds, the sending bank compares the IBAN and name with the receiving bank. If the names match, the transfer is made. If the difference is too great, an error message is displayed.

- Upper and lower case letters, umlauts or special characters are not a problem.

- However, incorrect or incomplete names will result in a warning message.

Important: If you insist on processing the transfer despite the warning, you yourself are liable. By displaying the warning, the bank releases itself from any liability.

What about international transfers?

If the transfer is not made within Germany but to another country, different factors determine whether the name check takes place or not.

First of all, the legal obligation to match names and IBANs only applies to SEPA transfers in euros.

- SEPA transfers in euros, including to other EU countries or other SEPA member states (e.g. France, Austria, Spain, but also Iceland, Switzerland or Norway), are subject to the new regulation.

- Foreign transfers in other currencies (e.g. CHF, DKK, NOK) are not affected

- Non-SEPA payment methods such as SWIFT transfers, credit card payments, PayPal or other payment service providers are not subject to the new obligation.

What does the change mean for collective transfers?

In addition to individual SEPA credit transfers, credit transfers in bundles, so-called batched credit transfers, are particularly relevant in the business environment.

With a batched transfer, many transfers can be executed at once. This is an advantage for companies and organizations, for example when transferring salaries.

Banks will also have to match names and IBANs for batch transfers from October 2025. For the payer, it will be all the more important that each individual name of the payee is correct.

How to avoid errors before sending

The new change makes it more important to maintain transfer data properly.

Especially in a business environment and with a large volume of transfers, incorrect data can quickly become a problem if you delay payments. We therefore recommend using a banking solution that supports this.

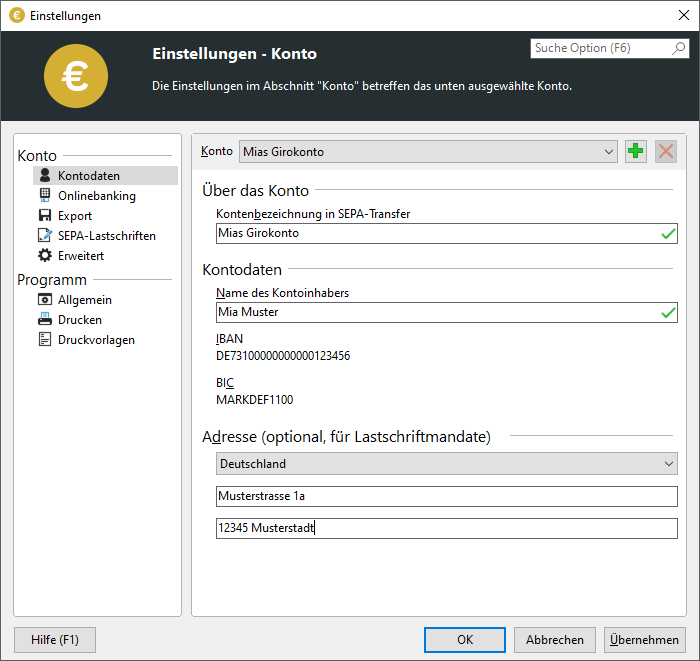

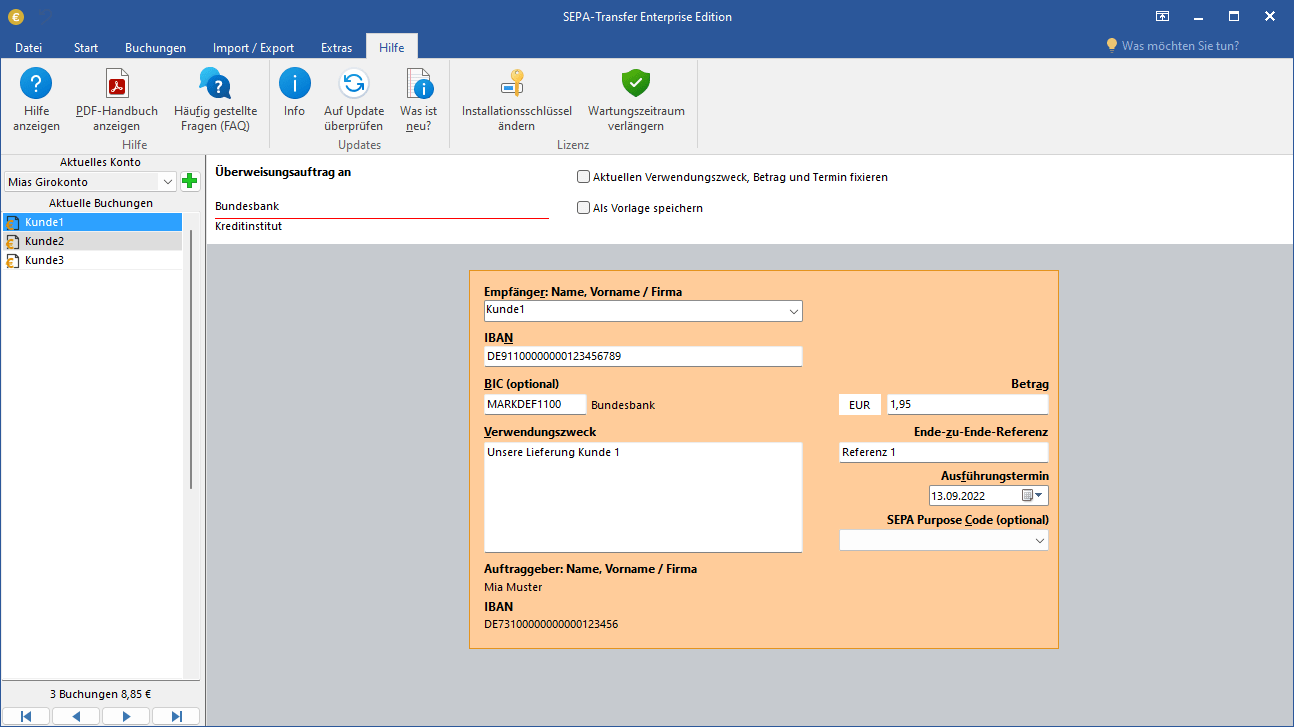

SEPA Transfer helps you to keep track of payment data for thousands of credit transfer recipients.

With the integrated templates for transfers in SEPA Transfer, you not only become more efficient when creating transfers. They also ensure that the recipient name always matches and thus avoid queries.

Protect yourself against failed SEPA transfers at an early stage. Download your free trial version of SEPA Transfer now.

Do you have any further questions? We look forward to hearing from you!