The Creditor ID explained easily

In Germany, companies need a creditor ID to execute SEPA direct debits with their customers. The creditor ID is a multi-digit identification number with letters and numbers issued by the German Bundesbank.

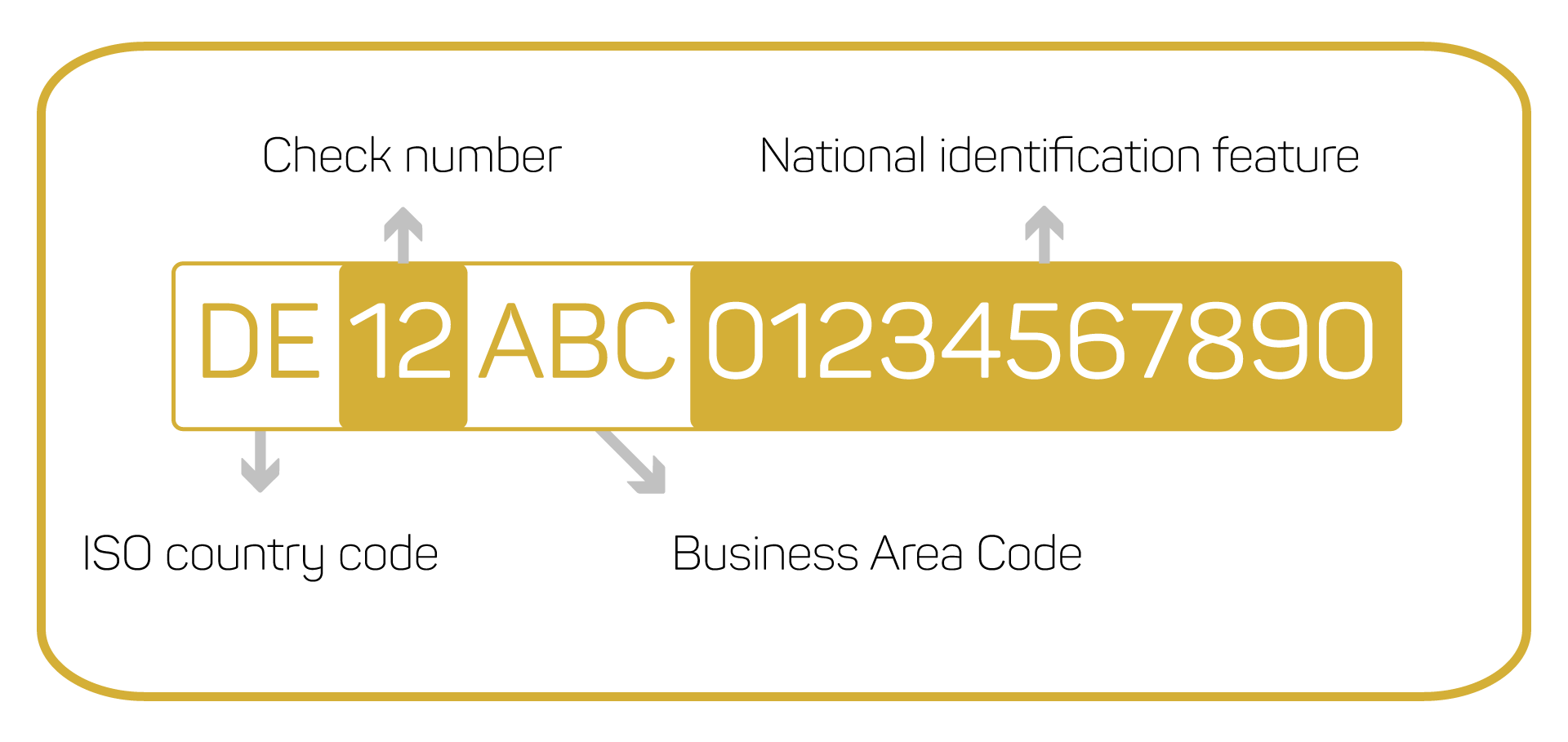

The creditor ID has a uniform structure. Explained easily: The length of the identification number varies depending on the country and contains the following information:

- ISO country code - The ISO country code consists of two letters and uniquely identifies the country from which the creditor originates.

- Check number - The check number, or check digit, consists of two digits.

- Business Area Code - The Business Area Code is alphanumeric, has three digits and can be requested by the creditor.

- National identification feature - The national identification feature for the direct debit creditor is sequentially ascending.

Where to get the creditor ID?

In Germany, the creditor ID is issued upon request by the German Bundesbank. A creditor ID needs to be requested using the online platform of the Bundesbank. It can't be requested offline under any circumstances or through traditional paper forms.

When the application is submitted, the affiliation to a group of persons, legal form and some other data, such as (company) name, address and contact details are requested. If the application is received successfully, the Bundesbank sends the new creditor ID via email.

Collective direct debits and Excel import of payment data

As soon as you received your creditor ID from the Bundesbank, you can use it to execute SEPA direkt debits. Doing so, collective direct debits might come in handy for you, too. Collective direct debits allow to send multiple SEPA direct debits to the bank in a bulk. That's a quick and easy way to save a lot of time.

You need a digital banking tool, like SEPA-Transfer, in order to execute a collective direct debit. You can deposit your creditor ID in SEPA-Transfer and import the payment data for your collective direct debit from Excel. Bides Excel, SEPA-Transfer supports data import from CSV, SEPA-XML as well as import payment data from your database in SEPA-Transfer Enterprise Edition.

Try out SEPA-Transfer yourself

SEPA-Transfer helps you to store your creditor ID as well as executing SEPA payments. Test SEPA-Transfer yourself with our 30-days trial version for free.

SEPA-Transfer Small Business Edition